So, will there be joy in Mudville?

In 1888, the writer and poet Ernest Thayer wrote “Casey at the Bat,” which has been dubbed “the single most famous baseball poem ever written.”

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💵

The poem tells the story of an overconfident player who steps up to the plate at a critical moment late in a ballgame and — spoiler alert — strikes out.

Thayer wrote “Casey at the Bat” more than 100 years before Nvidia (NVDA) came into existence. But Stephen Guilfoyle referred to one of the best-known poems in American literature in his recent TheStreet Pro column about the AI-chip giant’s fiscal-fourth-quarter results, which are due out after the bell on Wednesday, Feb. 26.

“Mighty Casey is on deck,” Guilfoyle said. “No, not at the bat, not yet anyway. On Wednesday afternoon, the most important earnings release of this season as well as the past few is due.”

Related: Nvidia shocks investors, buys and sells popular AI stocks

The veteran trader, whose career dates back to the floor of the New York Stock Exchange in the 1980s, said Nvidia’s guidance, in addition to results, will be in investors’ focus, given the recent massive blow that DeepSeek inflicted upon the tech sector.

The Chinese startup, developed by a former hedge fund manager in 2023, caught American tech companies flatfooted when it claimed to have built, trained and launched an AI-powered Chatbot, the R1, at a fraction of the price of the systems produced by its U.S.-based rivals.

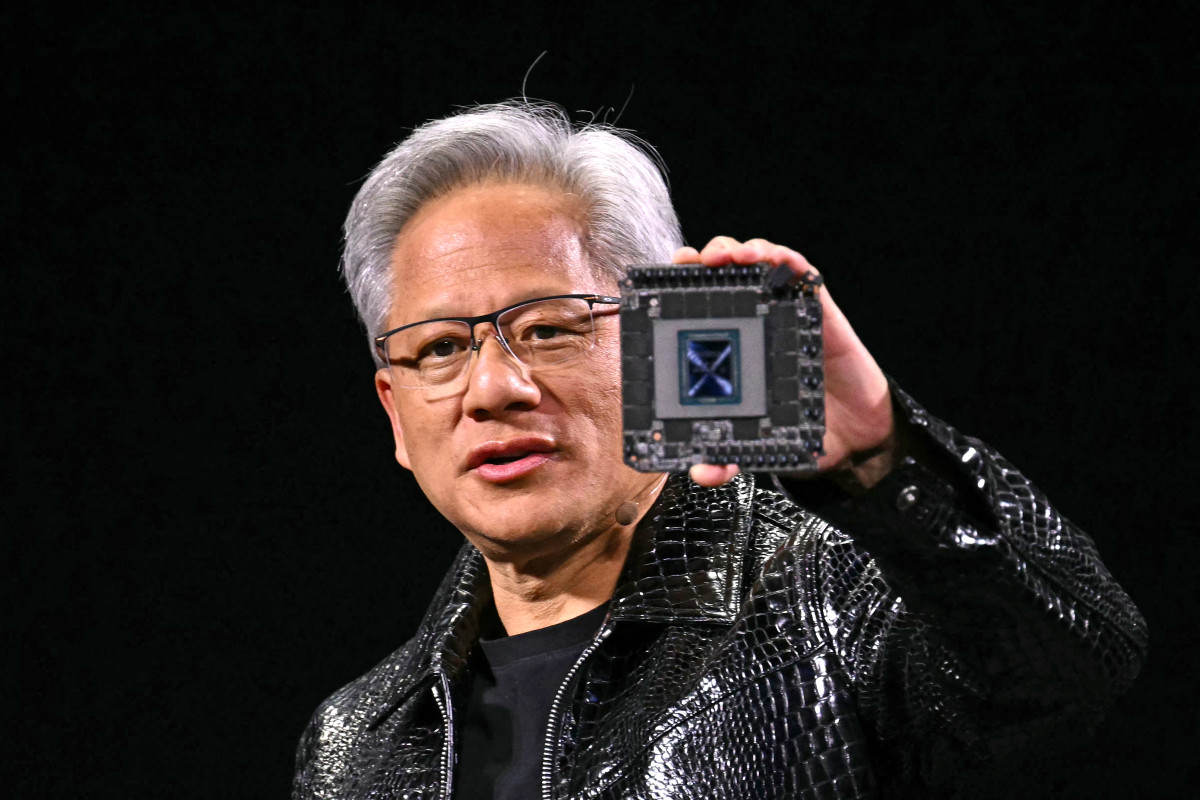

Nvidia CEO Jensen Huang reportedly met with President Donald Trump at the White House. (Photo: Patrick T. Fallon/AFP via Getty Images)

Nvidia CEO Jensen Huang reportedly met with President Donald Trump at the White House. (Photo: Patrick T. Fallon/AFP via Getty Images)

PATRICK T. FALLON/Getty Images

Trader: Nvidia investors might have more to worry about

News of the launch and its implications for AI-investment spending over the coming years triggered a $593 billion one-day slump in Nvidia’s market capitalization, the largest such decline on record.

“For the first time in a while, Nvidia investors have more to worry about than simply how overwhelmingly terrific the firm’s sales growth will be and how incredibly awesome margin performance will be,” Guilfoyle wrote.

Nvidia’s shares have been down for the past five days after Bloomberg reported that President Donald Trump’s administration is sketching out tougher curbs on U.S. semiconductor exports and pressuring key allies to escalate their restrictions on China’s chip industry.

Nvidia Chief Executive Jensen Huang met with President Donald Trump at the White House last month to discuss DeepSeek and tightening AI chip exports, according to Reuters.

Trump did not provide details of the meeting but called Huang a “gentleman.”

“I can’t say what’s gonna happen. We had a meeting. It was a good meeting,” Trump said.

“We appreciated the opportunity to meet with President Trump and discuss semiconductors and AI policy,” an Nvidia spokesperson said in a statement. “Jensen and the President discussed the importance of strengthening U.S. technology and AI leadership.”

2025 stock market forecasts

- Veteran trader who correctly picked Palantir as top stock in ‘24 reveals best stock for ‘25

- 5 quantum computing stocks investors are targeting in 2025

- Goldman Sachs picks top sectors to own in 2025

- Every major Wall Street analyst’s S&P 500 forecast for 2025

Nvidia is also contending with the looming threat of the tariffs Trump has threatened for imports to the U.S.

Guilfoyle also noted the rollout of Nvidia’s next-generation Blackwell chip platform, which is the successor to the highly successful platform built on the Hopper architecture.

“The firm’s launch of its Blackwell architecture hit a few snags on its way to market, though the firm has publicly claimed that all systems were up and running and the rollout was on track,” he said.

While that was indeed an obstacle, Guilfoyle added, “it is believed that demand for a lower-end Blackwell product known as the HGX B200 and the H20 to Chinese clients may have surprised to the upside.”

Analysts would be buyers of Nvidia

“So, readers, traders and investors can see that though the headline numbers for the fourth quarter may not be at all that much risk, the composition and sustainability of those Q4 numbers will be open to scrutiny as will the firm’s forward-looking guidance,” he said.

Wall Street is calling for adjusted earnings of 85 cents a share on revenue of about $38.15 billion, compared with 52 cents a share on $22.1 billion in revenue a year earlier.

Related: Analyst reworks Nvidia stock price target with Q4 earnings on deck

Guilfoyle said this would be good for earnings growth of 63% on revenue growth of 73% and “that would be incredible growth for every firm not named Nvidia.”

“My bullish case target price? $176,” he said..”I add? Not ahead of earnings.”

Despite the recent challenges, Nvidia reportedly remains popular with investors.

“Nvidia continues to be the golden child of the AI revolution,” said Dan Ives, managing director at Wedbush and one of Wall Street’s biggest AI bulls, according to the Wall Street Journal. “Nothing’s changing that, including DeepSeek.”

Investors are scooping up Nvidia options contracts that would pay out if the shares jump after the earnings report.

Mike Smith, a management consultant in Jersey City, said January’s AI jitters were “just a flash in the pan.”

“It’s really hard to think of any scenario where Nvidia is less important in 10 years,” he told the Journal.

Bob Lang said on TheStreet Pro that “the stock is likely to move big time over the coming days, so be ready for an opportunity if it falls.”

“We like Nvidia in TheStreet Pro Portfolio and rate is a one, or buy at anytime,” he said.

Evercore analysts are buyers of Nvidia

Evercore ISI analysts said they would be buyers of Nvidia into the company’s January-quarter earnings call.

While Nvidia has bounced by 12% off its recent Feb. 3 low, the stock has still underperformed the S&P 500 by 7% over the past month, the investment firm said.

Though Evercore, which has an outperform rating and $190 price target on the shares, does not expect Nvidia to post a “material beat/raise print,” it views the Santa Clara, Calif., group as “the cheapest AI stock in our coverage universe.”

Related: Veteran analyst sounds the alarm on Google and Mag 7

The firm also says a slight beat/slight raise coupled with positive commentary about visibility and Blackwell in the second half of 2025 would “prove to be a positive catalyst.”

So, what will happen when the mighty Nvidia steps up the plate? That depends.

“How well the stock does post-earnings may have a lot to do with how well CEO Jensen ‘The Fonz’ Huang can tap dance,” Guilfoyle said, referring to Huang’s trademark leather jacket.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast