Nvidia shares jumped in early trading ahead of the AI-tech giant’s highly anticipated fourth quarter earnings report, due after the close of trading.

Nvidia (NVDA) is expected to post a bottom line of $25.3 billion, or 84 cents a share, with a gross profit margin in the region of 73.5%.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰💵

On the revenue side, analysts see an overall top line of $38.05 billion, a 72% increase from a year earlier, with its key data center segment booking revenue of around $33.6 billion.

Beyond the headline numbers, however, investors are likely to focus on a series of challenges the group will face heading into the coming year, many of which have contributed to the shares’ year-to-date decline of around 8.5%.

Below is a quick compendium of five key issues investors are likely to focus on when Nvidia reports after the close of trading on Wednesday.

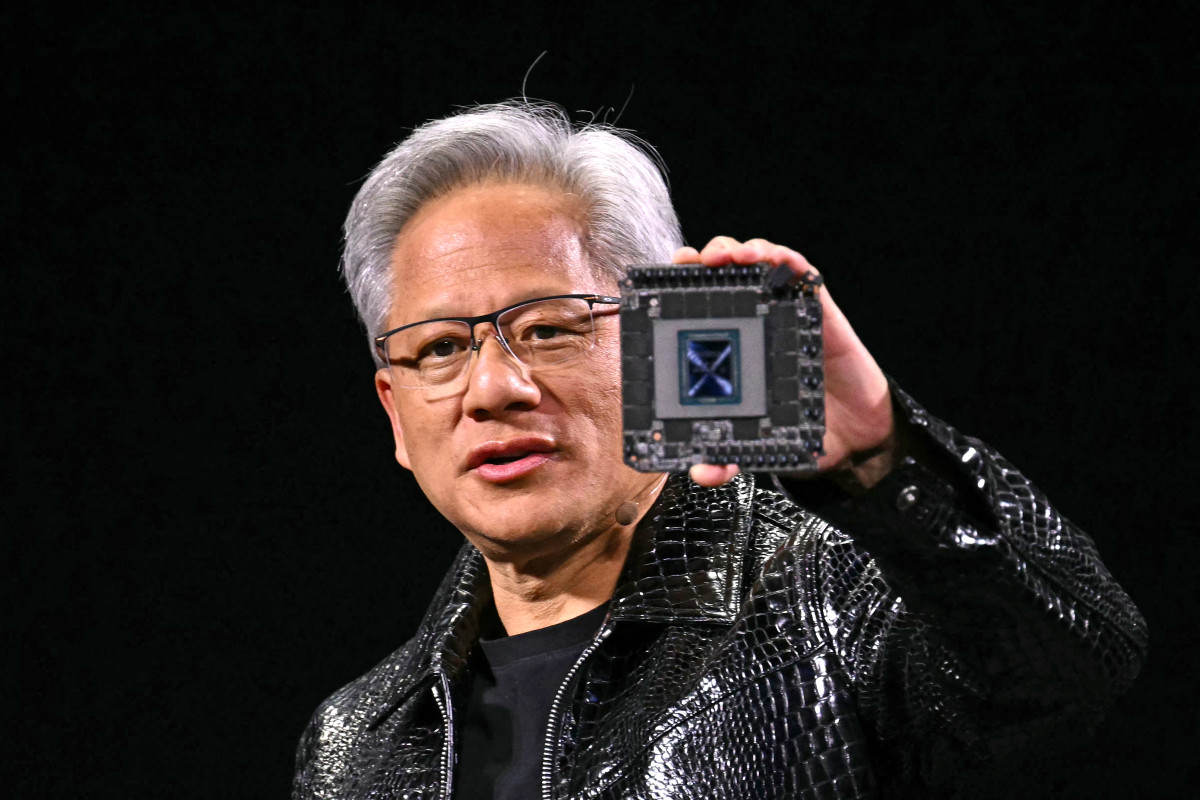

Nvidia CEO Jensen Huang will likely address a series of issues facing the AI chipmaker when he speaks to investors after the group’s fourth quarter earnings.

Nvidia CEO Jensen Huang will likely address a series of issues facing the AI chipmaker when he speaks to investors after the group’s fourth quarter earnings.

PATRICK T. FALLON/Getty Images

1. Nvidia’s near-term forecasts

Nvidia traditionally guides investors only one quarter ahead and typically focuses on revenue and gross profit margins. That’s a contrast with many companies in the tech space that issue full-year forecasts.

Analysts expect Nvidia to forecast April-quarter revenue in the region of $41.75 billion, implying a 60% growth rate from a year earlier, with margins likely steady at around 73.5%.

Key to this year’s forecast, however, will be commentary from CEO Jensen Huang and/or his finance chief, Colette Kress, on when revenue from its higher-priced Blackwell line of processors will overtake those from its legacy Hopper chips.

Related: Nvidia earnings can kickstart a comeback for U.S. stocks

“A strong quarter is great, but as long as their results align closely with expectations, my main focus remains on their forward guidance — that’s the biggest factor for me,” said Joe Tigay, portfolio manager at Catalyst Nasdaq-100 Hedged Equity Fund. “I’m a long-term believer in Nvidia, but I don’t expect another 140% growth year.”

“The era of easy money may be behind us, but I still see strong returns ahead,” he added.

2. DeepSeek impact on Nvidia

Nvidia shares suffered the biggest single-day decline of any company on record last month, with nearly $600 billion in market value wiped away after China-based DeepSeek’s RI AI chatbot was unveiled.

The startup, founded in 2023 by a former hedge fund manager, claims to have built a large-language-model system using lower-priced H800 chips and innovative training methods.

Investors feared that U.S.-based rivals, many of which have committed billions in AI-related spending, would pare back those plans in the wake of DeepSeek’s launch, resulting in canceled Nvidia sales and lower revenue forecasts.

Related: Top analyst revisits Nvidia stock price target amid DeepSeek questions

“We are not overly concerned about the impact from efficient models such as DeepSeek and/or competition from [custom chipmakers], and view any pullback as an opportunity,” said Raymond James analyst Srini Pajjuri.

Further, some analysts have argued that DeepSeek’s success with cut-priced chips and processors could stoke further sales growth, particularly in China, where U.S. export rules limit the options of cloud-service providers and other DeepSeek competitors.

Huang’s commentary on DeepSeek’s surprising breakthrough — amid reports that it was able to acquire higher-end Nvidia chips through back channels and the impact it will have on the spending plans of the giant providers of cloud services and infrastructure — will be keenly tracked by investors later today.

3. Nvidia faces rising competition

Nvidia commands an estimated 80% share of the market for AI-powering chips and processors. The dominance creates a competitive moat that not only allows it to take in a massive share of the billions in hyperscaler spending but also limits the ability of competitors like Advanced Micro Devices (AMD) , Broadcom (AVGO) and Marvell (MRVL) to erode its market leadership.

That could mean that a softer-than-expected set of fiscal-Q4 earnings, or a muted near-term outlook, from Nvidia could paradoxically be positive for the broader AI chip sector. That’s because such a result would enable competitors to challenge Nvidia’s leadership and provide more options for the large hyperscalers, as well as smaller cloud providers and individual companies, to develop their AI infrastructure.

Related: Nvidia slashes stake in emerging rival as AI arms race heats up

“We expect the narrative and news flow across the AI space to continue to be erratic in the intermediate term,” said CFRA analyst Angelo Zino. “[But] in the long term, increasing competitive pressures will help support greater adoption of the technology as enterprises will be able to tap into more cost-effective options that can produce significant productivity improvements.”

4. Nvidia’s ramp-up of the new Blackwell chips

Nvidia is ramping the production of its Blackwell processors, the latest line in its impressive AI arsenal, despite supply-chain constraints that have slowed deliveries of the powerful, yet energy-efficient, systems.

Key to the ramp will be the production and marketing of its GB200 NVL72, a liquid-cooled computing system based on 72 interconnected Blackwell processors built into a single rack.

“We believe EMS and server partners are struggling significantly with ramp of GB200 NVL racks and believe shipments in [fiscal Q4 and Q1] are tracking well below plan,” said KeyBanc Capital Markets analyst John Vinh. “We estimate GB200 rack shipments” of more than 1,000 in the fiscal fourth quarter and more than 2,000 in fiscal Q1.

Related: Analyst reworks Nvidia stock price target on Blackwell demand forecast

Huang will likely speak to supply constraints and how they have affected NVL72 orders, which by some estimates carry a $3 million price tag. Analysts are expecting sales in the region of $105 billion from the NVL72 rack, nearly half of Wall Street’s $197 billion revenue forecast for the year.

5. Export restrictions affecting Nvidia

In the coming year and beyond Nvidia will need to navigate an increasingly complex set of rules and restrictions on the sale of high-end technologies to non-U.S. companies. The focus will be on new regulations from the Trump administration.

White House officials have reportedly looked at ways to limit both the quality and quantity of Nvidia chip sales to China, building on rules put in place by President Joe Biden, as part of a broader effort to maintain U.S. leadership in the AI space.

Related: Nvidia stock faces fresh China concerns

Legacy “diffusion” rules, put in place earlier this year, are also a concern, in that they set limits on the amount of AI computing power U.S. companies can ship to different countries.

Earlier this year, Nvidia’s vice president of government affairs, Ned Finkle, called the Biden-era rules a “sweeping overreach … that seeks to undermine America’s leadership with a 200+ page regulatory morass, drafted in secret and without proper legislative review.”

Investors will look for commentary from Huang, who met with Trump in Washington late last month, on both the new administration’s policies and its likely impact on Nvidia sales and the broader AI sector.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast