The big “R” has become a major focus among stock market participants this month—and for good reason. We’ve seen a slate of concerning economic data on inflation and jobs, and uncertainty over tariffs hasn’t helped combat recession fear.

As a result, investors, not known for their patience, have hit the reset button, selling stocks that had rallied significantly over the past two years while they digest the barrage of news.

This shoot-first-ask-questions-later mentality has sent the S&P 500 reeling nearly 10%. It’s been worse for the tech-heavy Nasdaq, home to most of the biggest gainers over the past two years. The Nasdaq 100 was down 13% from its February peak at its worst levels on March 10.

The rapid descent has caught many people flat-footed and stoked concerns that recession fear could become a self-fulfilling prophecy.

Related: Treasury Secretary has blunt 3-word response to stock market drop

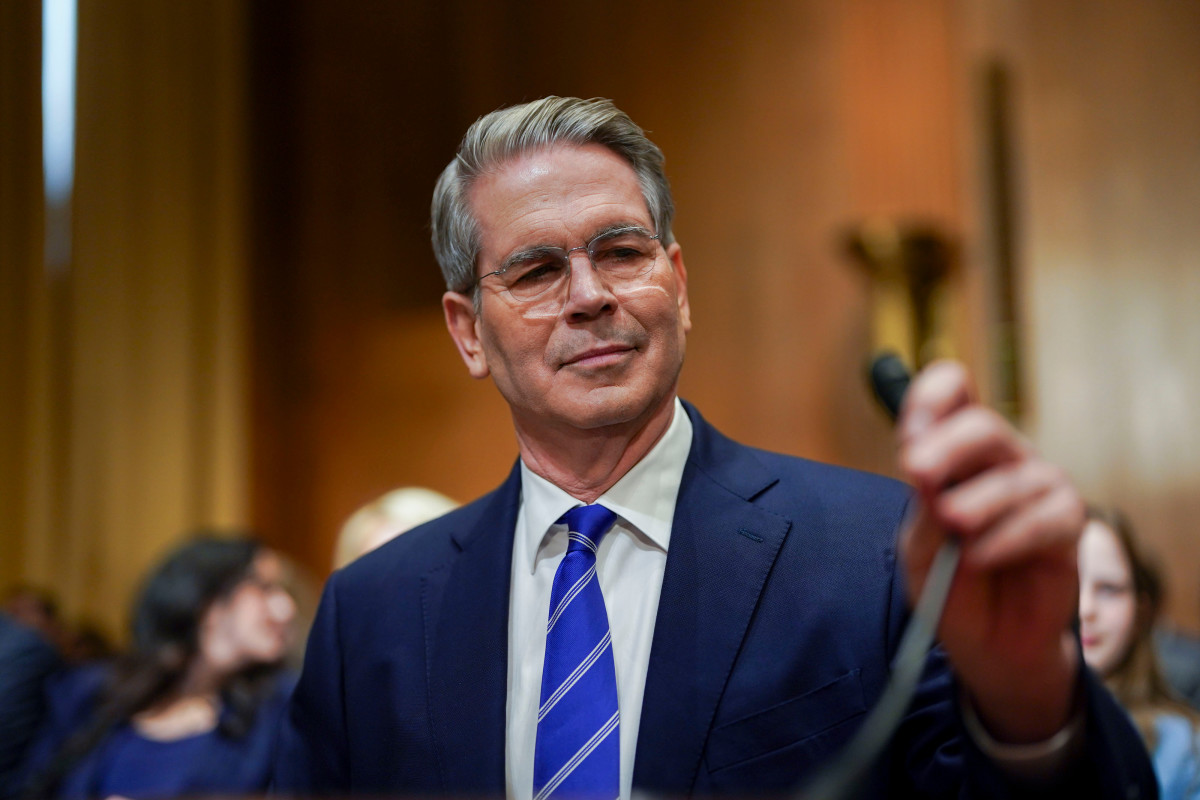

The situation isn’t lost on Treasury Secretary Scott Bessent.

Bessent is a longtime stock market watcher who trained under the billionaire hedge-fund legend Stanley Druckenmiller. He served as chief investment officer of Soros Fund Management before starting his own hedge fund in 2015.

Bessent has seen a thing or two while navigating the markets. In a recent speech, he indicated investors may be ignoring some key points in the recession debate.

Treasury Secretary Scott Bessent recently weighed in on the economy.

Treasury Secretary Scott Bessent recently weighed in on the economy.

Why the stock market is so worried about a recession

The stock market selloff isn’t all that shocking when you consider valuations were priced for perfection, and recent economic data are far from perfect.

While inflation has retreated significantly from its 8% peak in 2022, it has increased since the Federal Reserve pivoted last fall to interest rate cuts from hawkish monetary policy.

Related: Fed chairman has blunt 9-word response to recession talk

Consumer Price Index inflation was 3% in January, up from 2.4% in September. The rebound in inflation forced the Fed, which cut rates in September, November and December, to pause further interest rate cuts until it has more confidence that either inflation is retreating again or the jobs market is worsening.

Recent unemployment data suggest cracks in the employment market. The rolling average number of people filing for unemployment benefits over the past four weeks was 224,250 last week, the highest since December.

The Bureau of Labor Statistics’ February jobs report showed the U.S. unemployment rate inched up to 4.1% from 4% in January. The unemployment rate was 3.5% as recently as 2023, and a wave of federal job losses in the wake of the Department of Government Efficiency budget cutting could pressure that figure even more this year.

It doesn’t help that the latest Job Openings and Labor Turnover Survey, known as the Jolts report, showed 1.3 million fewer unfilled jobs in January than one year ago.

Related: Scott Bessent’s net worth: Trump’s Treasury Secretary’s wealth in 2025

We’ve also seen consumer confidence drop. The Conference Board’s February consumer confidence survey posted the sharpest one-month decline since 2009. Importantly, its Expectations Index dropped to 72.9, the first reading below 80 since last June. Historically, levels below 80 usually signal a looming recession.

The slate of worrisome data collected so far this quarter has the Atlanta Fed’s GDPNow forecasting tool suggesting -2.4% growth in the first quarter. That number will improve as more data come available. Still, first-quarter GDP seems on track to fall shy of the 3% growth recorded in the second and third quarters of 2024 and the 2.3% growth in Q4.

Scott Bessent suggests markets are focusing on the wrong things

So far, the Trump administration has struck a somber tone, warning of a transition period of “adjustment” as the economy reacts to austerity and the enactment of 25% tariffs on Mexico and Canada and 20% tariffs on China.

Related: Veteran fund manager who correctly forecast S&P 500 crash updates outlook

Those tariffs could further increase inflation as companies across many industries pay more for imports, forcing them to increase prices to compensate for the added expense. It could also cause a profit swoon at corporations that are unable to fully pass along those higher import costs to their already cash-strapped consumers.

Bessent argues that any inflation increase from tariffs would be temporary.

“Over the coming months, we’re going to have a couple of adjustments […] as we deleverage the government sector relative to the private sector,” said Bessent in an interview with Larry Kudlow at the Economic Club of New York. “Can tariffs be a one-time price adjustment? Yes.”

Bessent argues that the one-time hit to inflation caused by tariffs may be offset by savings elsewhere.

“We have 10-year interest rates lower; mortgage rates are lower since President Trump came into office,” said Bessent. “And as of last night, crude prices are down 15%. So, across the continuum, I’m not worried about inflation.”

When the Fed cut its Federal Funds Rate by 1 percentage point last year, 10-year Treasury note rates rose rather than fell, causing mortgage rates (and other lending rates) to increase rather than decrease. This created a headwind for borrowers on everything from homes to credit cards.

More Economic Analysis:

- U.S. consumers are wilting under renewed stagflation risks

- Jobs reports provide critical look at economy, could roil markets

- Fed inflation gauge indicates big changes in key economic driver

Now, the 10-year is perhaps retreating on hopes that austerity will require less issuance, reducing supply. Or it may simply be because worries about recession are likely to put more Fed cuts back on the table in 2025. Either way, a lower 10-year Treasury note rate and cheaper oil could take some of the bite out of wallets caused by tariffs.

That’s not the only thing Bessent wants market watchers to remember. He also says tax policy, deregulation and the shift from government to private capital will benefit wallets and the economy.

“Full expensing [of capital equipment] will create a window, and perhaps having full expensing of factories within that window so equipment and factories … could be very powerful,” said Bessent.

Regulation is an underconsidered tax on households, Bessent argued, suggesting that deregulation could help consumers’ budgets. Lowering business-tax rates could encourage more business activity. If income from tariffs enables the U.S. to eliminate taxes on Social Security, tips and overtime, it could mean more money in workers’ pockets, he said.

And if tariffs shift production back to the U.S. from places like China, it could be good for the jobs market.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast