U.S. stock losses deepened in afternoon trading Monday, while the dollar extended its weeks-long slump and Treasury bonds rallied, as investors extended their retreat from risky markets amid broadening concerns that President Donald Trump’s tariffs and cuts to government jobs could tip the world’s biggest economy into recession.

Updated at 3:05 PM EST

Correction in sight

The S&P 500 is now nearing correction territory, having now slumped 9.17% from its all-time closing high of 6,144.15 points on February 19. The Dow is also in free-fall, and was last marked more than 1,000 points lower on the session to extend its 2025 decline to around 1.5%.

Tesla shares, meanwhile, are leading tech stocks lower and were last seen more than 15% on the day, taking their recent peak-to-trough decline to around 50%, amid the biggest single-session slump in more than four and a half years.

Updated at 1:31 PM EST

Getting worse

The S&P 500 was last marked 137 points, or 1.37% lower on the session, with the Nasdaq down 693 points, or 3.8% lower. The Dow was last marked 633 points.

“The market is bipolar,” said Gina Bolvin, president of Bolvin Wealth Management Group. “We’ve gone from animal spirits to what are the odds of a recession, from the 10 year flirting with 5% to falling to 4.2, from raising rates in order to slow the too hot too hot economy growing at 3.9% GDP and three weeks later we’re talking about–2.5% GDP with a need for emergency cuts

Just two years ago we were worried about the regional banking crisis. Last August it was the Yen carry trade. Deep Seek. GDP Now extrapolating January data Now, tariffs,” she added. “This is a headline driven market; one that could change in an hour.”

Related: Analysts revisit S&P 500 forecasts amid recession worry

Updated at 10:54 AM EST

Session lows

The S&P 500 is now down 2% on the session, and near the lowest levels since September, as stocks extended the early March slump amid renewed tariff, job cut and recession risks.

The CBOE Group’s VIX index, meanwhile, hit a fresh year-to-date high of $26.87 earlier in the session, a level that suggests daily swing of around 1.67%, or 95 points, for the S&P 500.

“Technical damage within the index is a growing concern. Only 53% of the index remains above their 200-day moving average,” said Adam Turnquist, chief technical strategist for LPL Financial.

“While this reading remains above the January low level of 52%, it leaves little room for error as 50% is the general threshold used to bifurcate bullish and bearish market breadth,” he added.

Benchmark 10-year Treasury note yields, meanwhile, have fallen 10 basis points from late-Friday levels to 4.215% amid a flight-to-safety move, although the U.S. dollar index remains in negative territory on the day at 103.824.

Mid-20s $VIX is not where the bulls want to beLow forward SPX returns.. pic.twitter.com/I9LO5ZrcoR

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 10, 2025

Updated at 10:17 AM EST

No relief

Tesla (TSLA) shares extended their weeks-long decline in early trading, pulling the stock to the lowest level since late October, following a weekend of targeted protests and two sell-side ratings changes tied to the EV maker’s sales slump.

UBS analyst Joseph Spak cut price target by $34, to $225 per share, with a ‘sell’ rating, with Redburn-Atlantic analyst Adrian Yanoshik reiterating a ‘sell’ rating into “another year of stalled volumes” with “cash flows strained under higher inventories into refreshed Model Y deliveries and

Tesla shares were last marked 8.4% lower in early trading to change hands at $240.72 each.

Related: Top analyst reworks Tesla stock price target amid global sales slump

Updated at 9:37 AM EST

Big red

The S&P 500 was marked 80 points, or 1.43% lower in the opening minutes of trading, with the Nasdaq off 390 points, or 2.15%.

The Dow slumped 366 points while the mid-cap Russell 2000 fell 30 points, or 1.44%.

“There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs,” said Chris Larkin, managing director for trading and investing at E*Trade from Morgan Stanley.

“The S&P 500 ended last week just a little more than 6% below its all-time high, but to many investors it probably feels like more, given the market is coming off its first three-week losing streak since last August,” he added. “Until there’s more clarity on trade policy, traders and investors should anticipate continued volatility. This week’s inflation numbers will provide another test.”

S&P 500 Opening Bell Heatmap (Mar. 10, 2025)$SPY -1.33% 🟥$QQQ -1.69% 🟥$DJI -0.96% 🟥$IWM -1.04% 🟥 pic.twitter.com/g5TjoUpSGB

— Wall St Engine (@wallstengine) March 10, 2025

Stock Market Today

Stocks ended firmly higher on Friday, following another whipsaw session that saw the market’s benchmark volatility gauge rise to the highest levels since December following a late-session rally tied to positive comments from Federal Reserve Chairman Jerome Powell ultimately lifted stocks into the green, but the S&P 500 still ended the week with its biggest loss since September.

Investors aren’t motivated to boost stocks much further this week, however, following weekend comments from President Donald Trump, who failed to rule out the chance of recession and defended his on-again-off-again tariff rollout as necessary in his effort to rebalance the economy.

“I hate to predict things like that,” Trump told Fox News’ Maria Bartiromo when asked if the economy faced recession risks.

“There is a period of transition because what we’re doing is very big. We’re bringing wealth back to America,” he added. “That’s a big thing, and there are always periods of, it takes a little time. It takes a little time, but I think it should be great for us.”

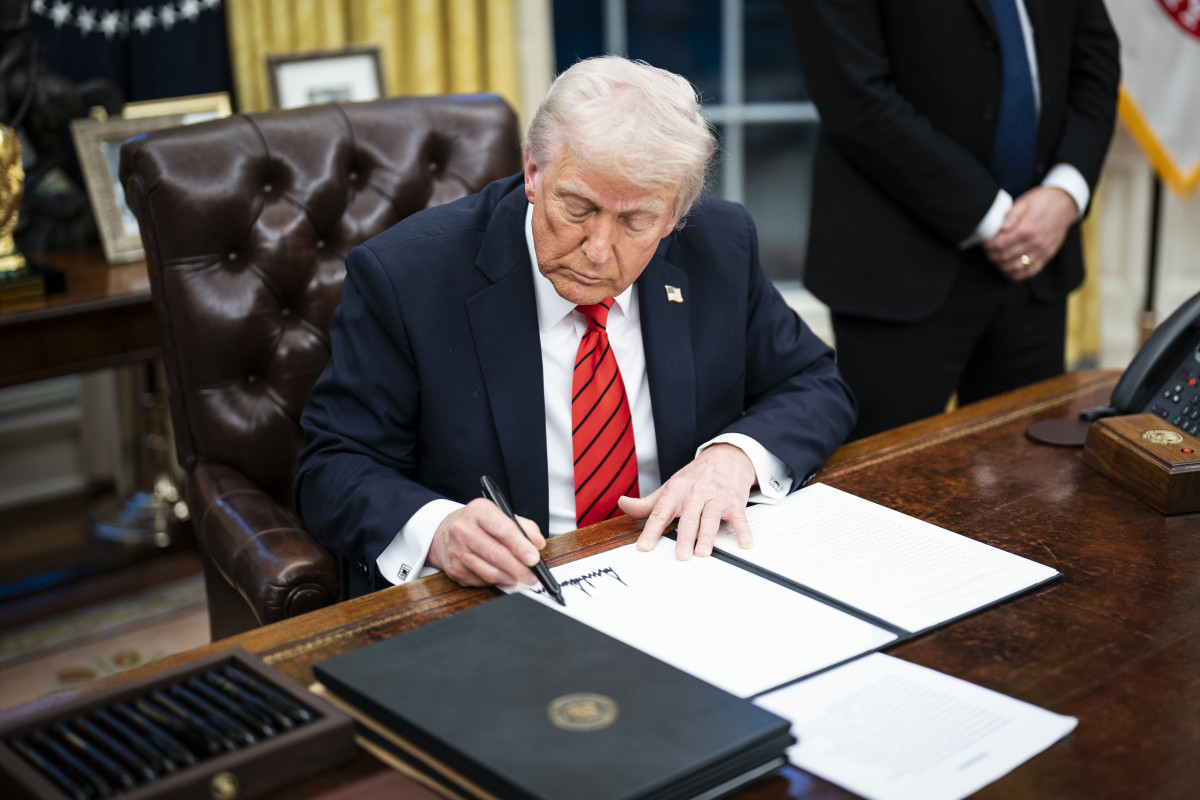

President Donald Trump refused to rule out the risk of recession in a weekend interview that underscored his focus on tariffs.

President Donald Trump refused to rule out the risk of recession in a weekend interview that underscored his focus on tariffs.

The Washington Post/Getty Images

New levies on steel and aluminum imports could be imposed this week, and Trump hinted Friday that some so-called reciprocal tariffs could be applied to goods from Canada and Mexico before the 30-day relief period he established last week.

Beyond tariffs, markets are likely to focus on a key set of inflation readings this week, with CPI data for February due on Wednesday and producer-price figures slated for the following day.

A hotter-than-expected reading, paired with Friday’s weaker-than-expected jobs report, could stoke concern about the risk of stagflation if investors feel inflation is reaccelerating while the economy is slowing.

Related: Fed chair Powell echoes worries in interest rate forecasts

Only a handful of S&P 500 earnings reports are expected this week as the fourth-quarter reporting season draws to a close. Updates from Oracle (ORCL) and Adobe (ADBE) are likely to capture the market’s attention.

Heading into the start of the trading day on Wall Street, futures contracts tied to the S&P 500, which is down 3.1% for the month, are priced for an opening-bell decline of around 55 points.

The tech-focused Nasdaq, which slumped into correction territory on Friday from its late-December peak, is called 215 points lower while the Dow is priced for a 335-point pullback.

Benchmark 10-year Treasury note yields were last marked at 4.257% heading into the start of the New York trading session, a 5-basis-point decline from Friday, with 2-year notes trading 5 basis points lower at 2.946%.

More Wall Street Analysis:

- Analyst says AI stock picked by Cathie Wood will surge

- Analysts make surprise move on MongoDB stock price target

- Analysts reboot Rocket Lab’s stock price target after earnings

In overseas markets, Europe’s Stoxx 600 was marked 0.48% lower in midday Frankfurt trading, reversing a modest early gain, while Britain’s FTSE 100 slipped 0.28% in London.

Overnight in Asia, the biggest slide for CPI inflation in China in more than a year reignited deflation risks in the world’s second-largest economy, pulling the regional MSCI ex-Japan benchmark 1.02% lower into the close of trading.

Japan’s Nikkei 225, which hit a six-month low last week, edged 0.38% higher with tech stocks pacing the modest advance.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast